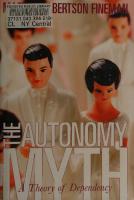

Between Dependency and Autonomy [Reprint 2020 ed.] 9780520323919

171 92 14MB

English Pages 240 [236] Year 2020

Polecaj historie

Citation preview

Between Dependency and Autonomy

Science, Technology

and the Changing

World

Order

edited by Ernst B. Haas and J o h n Gerard Ruggie Scientists and World Order: The Uses of Technical Knowledge in International Organizations,

by Ernst B. Haas, Mary Pat Williams and Don Babai Pollution, Politics, and International Law: Tankers at Sea,

by R. Michael M'Gonigle and Mark W. Zacher Plutonium, Power, and Politics: International Arrangements for the Disposition of Spent Nuclear Fuel,

by Gene I. Rochlin Between Dependency and Autonomy: India's Experience with the International Computer Industry,

by Joseph M. Grieco

Between Dependency and Autonomy India's Experience with the International Computer Industry Joseph M. Grieco

University of California Press

Berkeley • Los Angeles • London

University of California Press Berkeley and Los Angeles, California University of California Press, Ltd. London, England © 1984 by The Regents of the University of California Printed in the United States of America 1 2 3 4 5 6 7 8 9 Library of Congress Cataloging in Publication Data Grieco, Joseph M. Between dependency and autonomy. (Science, technology, and the changing world order) Bibliography: p. Includes index. 1. Computer industry—India. 2. International business enterprises— India. I. Tide. II. Series. HD9696.C63I44 1983 338.8'87 83-4866 ISBN 0-520-04819-9

To my parente, Mauro and Mary Grieco

Contents

List of Tables, viii Acknowledgments, ix List of Abbreviations, x Chapter I Chapter II Chapter III Chapter IV Chapter V Chapter VI

Introduction, 1 India's Changing Fortunes in Computing, 1960-1980, 16 The International Creation of Computer Opportunities, 53 India's Exploitation of International Opportunities, 70 Policies, Politics, and Computers in India, 103 Conclusion, 150

Notes, 171 Bibliography, 193 Multinational Enterprises, the "Assertive" Upper-Tier Developing Countries, and International Relations, 193 International Computer Technology and Industrial Structure, 200 The Indian Experience with the International Computer Industry, 207 The Experiences of Other Countries with High-Technology Multinational Enterprises, 215 Index, 219

Tables 1. Percentage of U.S. Affiliates Encountering Performance Requirements and Incentives in Selected Developing Countries, Through 1977 and 1970-1977, 18 2. Computer Market Structure of India, 1960-1972, 26 3. Lag of Foreign Computers in India, 1960-1972, 28 4. Computer Market Structure of India, 1960-1977, 34 5. Lag of Foreign Computers in India, 1960-1977, 36 6. Per-Bit Costs of ECIL and Selected IBM Main Memories, 37 7. Computer Market Structure of India, 1960-1980, 41 8. Partial Value of Indian Computer-Base at the End of the 1970s, 43 9. Lag of Foreign Computers in India, 1960-1980, 45 10. Processing Times and Costs of Computer Systems, 1955-1976, 54 11. Per Bit Main Memory Costs, 1955-1978, 55 12. Minisystems, 1955-1975, 57 13. Operations of U.S. Computer Enterprises in Developing Countries, Late 1960s to Late 1970s, 61 14. Operations of U.S. Computer Enterprises in Upper-Tier Developing Countries, Late 1970s, 65 15. Electronics Research and Development Funding Support by the Indian Government, 1970s, 76 16. Indian Government Support for Computer Research and Development, 1971-1978, 77 17. Indian Electronics, Mid-1960s to Mid-1970s, 123 18. Research and Development Funding of Electronics Commission and Department, by Recipient, 1971-1979, 124 19. ECIL System Recipients, 1971-1978, 127 20. Janata National Leadership: Ideology, Former Party Affiliation, and Position as of Early 1977, 143

Acknowledgments First and foremost I wish to thank Richard N. Rosecrance and Peter J. Katzenstein for their guidance during my graduate training in general and the development of this study in particular. For their suggestions and criticisms I would also like to thank Duncan L. Clarke, Jack Donnelly, Howard Erdman, Glenn Fong, Frank Golay, Ernst B. Haas, Stanley A. Kochanek, Frederick V. Kratochwil, Michael Mastanduno, John J. Mearsheimer, George H. Quester, Myron Rush, and Louis T. Wells. I am grateful to many institutions for their generous support of the research reported here: at Cornell University, the Center for International Studies, the Peace Studies Program, and the South Asia Program; at Princeton University, the Center of International Studies; at Harvard University, the Division of Research in the Graduate School of Business Administration; the Institute for the Study of World Politics; and the American Institute for Indian Studies. In preparing the study, I have relied upon information provided by individuals with firsthand knowledge of India's experience with the international computer industry. These individuals have requested that their identities not be reported, but they are aware that their names and notes taken by me of conversations with them are available to my special committee at Cornell. I shall not soon forget the assistance and, in many instances, the hospitality of these persons. To all persons I interviewed I offered an opportunity to review my "write-up" of conversations with them and to review chapters (and in the case of IBM executives, the entire manuscript) relating to their knowledge of computers in India. Many errors of fact were corrected as a result of these review procedures, and I thank these individuals for the time they devoted to the study. Of course, I alone am responsible for any error of fact or of interpretation.

Abbreviations AEC BARC BEL CAPRE CDC CU CMC DAE DCM ECIL FERA HCL IBM ICIM ICL I CT IDM IPAG MRTP ORG SEEPZ TIFR UNDP

Atomic Energy Commission Bhabha Atomic Research Center Bharat Electronics Limited Commission for Coordination of Electronic Data Processing Activities Control Data Corporation Compagnie Internationale pour Informatique Computer Maintenance Corporation Department of Atomic Energy DCM Dataproducts Division, Delhi Cloth Mills Electronics Corporation of India Limited Foreign Exchange Regulation Act Hindustan Computers Limited International Business Machines Corporation International Computers Indian Manufacture Limited International Computers Limited International Computers and Tabulators Limited International Data Management Limited Information, Planning, and Analysis Group, Electronics Commission of India Monopoly and Restrictive Trade Practices Act Operations Research Group, Sarabhai Enterprises Santa Cruz Electronics Export Processing Zone Tata Institute for Fundamental Research United Nations Development Program

Chapter I

Introduction

This study is concerned with an important dimension of change in the contemporary international system: the increase in power of certain developing countries in their political-economic interactions with the advanced capitalist societies. The study seeks to document a recent shifting in power away from high-technology multinational enterprises (originating from the advanced capitalist societies) and toward certain developing countries in which the firms operate. T o explore this shifting in power, the study describes and explains India's experience with the international computer industry between 1960 and 1980. T h e major empirical finding of the study is that India did increase its capacity to manage its ties with the international industry: there was in fact a shift in the balance of power away from individual international computer firms and in favor of India. As a result of this shift in the power relationship, there was also a change in the behavioral relationship between India and the international industry. India transformed its linkages with international firms in the industry and thereby enlarged its share of the benefits resulting from interactions between the country and the industry. One major objective of this study is to document and to explain how this power shift took place between India and the international computer industry. A second objective is to use this particular case as a way of evaluating two competing schools of thought on whether power balances between developing countries and agents of advanced capitalism can indeed change very significantly. One school of thought contends that longterm power balances typically favor developing countries at the expense of multinationals. This argument is in accord with the

2

Introduction

more general perspective which emphasizes the variety of ways developing countries increase their power in interactions with the advanced capitalist societies.1 Another school of thought contends that developing countries are unable to enhance their power significantly over multinationals. This argument is a part of the more general perspective which emphasizes the .basic powerlessness of developing countries in what is considered an unchanging and unjust capitalist international order. 2 India's experience with computers, it is suggested in this study, points to the overall analytical superiority of the first over the second school of thought. As with relations between the superpowers or among the advanced capitalist societies, changes in power are a fundamental characteristic of relations between developing countries and advanced capitalist societies. We will first discuss more fully the two schools of thought on relations between developing countries and multinational enterprises and then evaluate the usefulness of India's computer experience as a test case for the two schools. A brief discussion follows on the range of other developing countries to which India's experience with high-technology multinationals may be relevant. A chapter-by-chapter guide to this study's empirical findings and theoretical arguments is then presented, along with a few concluding thoughts on the limits or qualifications of this study's arguments. THE BARGAINING SCHOOL, T H E MARXIST-DEPENDENCIA SCHOOL, AND INDIA'S COMPUTER EXPERIENCE

Three propositions constitute the bargaining school's understanding of relations between developing countries and multinationals. 3 First, the terms by which an enterprise operates in a country, and the distribution of benefits between them, are the result of negotiations and the balance of bargaining power between the country and the company. Second, in early interactions the balance of power and of benefits often favors the multinational. T h e developing country may control access to its markets and resources, but the enterprise has more important bargaining assets through its control of capital, access to foreign markets, technology, and managerial expertise. Third, and most crucial, over time the host country is likely to gain access

Introduction

3

in varying degrees to the sources of bargaining power which earlier had been controlled by the enterprise. As the country attains greater bargaining power, it forces the balance of benefits to shift in its favor. In sum, according to the bargaining school, prolonged contacts with foreign enterprises afford developing countries the experience needed to manage these relations more effectively and to the greater benefit of the countries. The Marxist-dependencia school agrees with the bargaining school in observing that multinationals translate their superior power resources into the establishment of ties with developing countries benefiting the former much more than the latter. However, the Marxist-dependendistas see very little chance for developing countries to learn to change their relations with foreign firms.4 Developing country elites may choose not to be aggressive with foreign firms because they are co-opted by the latter. Alternatively, the elites may wish to be aggressive toward multinationals but are deterred from doing so out of concern for losing vital resources provided by the enterprises or out of fear of retribution by the multinationals' home governments. In sum, the Marxist-dependencia school believes that developing countries cannot or will not try to change their relations with multinationals, and therefore these countries' long-term development is inhibited by contact with foreign firms. Recent commentary on the case study method points- to the utility of India's computer experiences as a test of the relative strength of the bargaining and the Marxist-dependencia schools.5 If the most extreme phenomena predicted by a theory (i.e., "hard cases") actually are observed, then strong support is given to the theory. Involving a developing country and a technologically dynamic industry, the present case is just such a "hard case" for the bargaining school.6 According to the school developing countries can, in general, cause the balance of bargaining power to shift over time in their favor. However, causing this shift in power is most difficult for developing countries to effect, according to the school, in bargaining instances involving high-technology multinationals. For example, Raymond Vernon, a leading influence within the bargaining school, has chronicled the increasing power of developing host countries over multinationals first in natural

4

Introduction

resource industries and later in a variety of manufacturing industries. At the end of the 1970s Vernon believed, however, that not all multinationals were equally vulnerable to developing country pressures. Vernon argued that developing countries increasingly were gaining control over subsidiaries of some manufacturing multinationals, and in particular he believed that the diffusion of technology among such enterprises weakened individual firms as they bargained with developing countries.7 Yet Vernon observed: As long as a foreign-owned goose can still lay golden eggs . . . the policy of most developing countries has been to squeeze the goose, not destroy it or have it fly away. Accordingly, multinational enterprises that provide a unique function, such as to provide access to some difficult technology or some otherwise inaccessible foreign market, have generally been less vulnerable to government pressures while subsidiaries where withdrawal is thought to entail very little national loss have been more vulnerable. 8 Other representatives of the bargaining school have also argued that developing country control over high-technology multinationals is possible but difficult to achieve. As C. Fred Bergsten, Theodore Moran, and Thomas Horst noted in their discussion of the problem: Some investors will doubtless be relatively immune from this process [of increasing host-country control]. Where technology is complex, rapidly changing, and tightly held—such as computers—the shift in bargaining power toward developing (and other) host countries will proceed least rapidly. 9 Hence developing countries can exert some control over manufacturing enterprises, but this becomes progressively more difficult (but still possible) as the enterprises are involved in increasingly sophisticated industries. Instances of success by developing countries with high-technology multinationals are at the outer edge of the predictive power of the bargaining school. Therefore, if a developing country like India is successful with high-technology enterprises in an industry like data processing, then even the most extreme observation predicted by the bargaining school can be made, and this would give strong support to the school.

Introduction

5

On the other hand, the Indian case constitutes an "easy case" for the Marxist-dependencia school. According to this school, developing countries generally are unable or unwilling to change their relations with multinationals, but this is especially true in cases involving high-technology multinationals. As Peter Evans recently argued, when a developing country and a multinational bargain: "The position of the multinational is never stronger than when it is based on monopolistic control over new knowledge." 10 Evans suggested that in such bargaining encounters: "To put the argument in its most simplistic form, the best cards on the side of the locals are political. T h e multinationals' best cards are technological." 11 Evans also argued that hightechnology multinationals have succeeded in retaining control over corporate research and development programs while at the same time they have succeeded in making the consumption patterns in developing countries increasingly similar. According to Evans, these two factors give multinationals great power over developing countries: "Since consumption patterns (especially among consumers with enough income to make a difference) are becoming more homogeneous at a rapid rate while the multinationals' control over new knowledge is eroding only slowly, technology continues to be a strong card in most industries."12 Another recent Marxist-dependencia study of relations between multinationals and developing countries also concludes that high-technology multinationals are especially likely to prevail in bargaining encounters with developing countries. Douglas Bennett and Kenneth Sharpe argue that technological dependency combined with other political-economic weaknesses to cause the Mexican government to be unsuccessful in the early-1960s in negotiations with multinational automobile firms on their establishment of manufacturing operations in the country. 13 Most significantly, Bennett and Sharpe posit that this initial failure by the Mexican government led to the creation of tight limits on the government's bargaining power in subsequent negotiations with the foreign auto firms, for the latter became able to form ties with local Mexican political-economic actors (Bennett and Sharpe identify "suppliers, distributors, labor, and consumers") that could be used against the government. Bennett and Sharpe conclude that while developing

6

Introduction

countries may experience an increase over time in their bargaining power with respect to foreign enterprises in natural resource industries, the evolution of bargaining relations between developing countries and foreign firms in hightechnology consumer-goods manufacturing industries is likely to be very different. As they suggest: "Other things being equal, then, the balance of bargaining power in such a manufacturing industry may with time shift toward the transnational rather than toward the LDC." 14 It should be noted that the Bennett and Sharpe proposition concerning the possible diminution of developing-country bargaining power over time is precisely opposite that presented by the bargaining school, for the latter emphasizes the probable increase in bargaining power enjoyed by developing countries over time. Through its analysis of a fairly long time period (1966—1980) of actual bargaining between the Indian government and multinational computer firms, the present study may shed significant light on this key question of how power relations between developing countries and multinationals may change over time. Developing countries, according to the Marxist-dependencia school, are supposed to be at their very weakest when they bargain with high-technology multinationals. 15 They should attain very little if they try to change their ties with this set of enterprises. Hence a country like India should clearly fail, according to the Marxist-dependencia school, in bargaining with computer multinationals. If India is successful with such firms, then even a most obvious set of phenomena predicted by the Marxist-dependentistas is shown not to be observed in exactly the circumstances in which it should be observed. Success by India in computers would therefore cast severe doubt on the validity and strength of the Marxist-dependencia school. RELEVANCE OF THE INDIAN EXPERIENCE WITH COMPUTERS

Involving, as it does, a major developing country and a key high-technology industry, India's experience with the international computer industry is interesting in its own right. Also, a focus on this case permits a key test and comparative assessment of two major schools of thought on the power capabilities of developing countries as they interact with multinational en-

Introduction

7

terprises. Moreover, the case itself and the assessment it permits of the two schools may reflect on the more general problem of how much room for policy maneuver developing countries already enjoy or may come to attain in the contemporary capitalist international economy. However, most other developing countries have not attained the level of national power reached by India, and therefore India's experience with computer multinationals may not be indicative of the levels of success to which most developing countries can aspire as they negotiate with high-technology enterprises. On the other hand, India's industrial structure is similar to those of Brazil and Mexico. In terms of scientific manpower productively employed Brazil is close to India, and Brazil and Mexico match or exceed India in terms of financial resources available per science and technology worker. Hence, India's bargaining success with multinationals might be achieved as well by Brazil and Mexico at present. In addition, countries such as Colombia, Nigeria, and Venezuela have objectives with regard to national control over multinationals that are very similar to those of India, and over differing time horizons they might approach India in terms of potential bargaining power. As they attain the bargaining capabilities currently enjoyed by India, they increasingly will be able to view India's bargaining successes as a realistic standard to which they can aspire. 16 India, Brazil, and Mexico at present, together with countries such as Colombia, Indonesia, Nigeria, and Venezuela over the longer term, constitute most of what might be termed the emerging "assertive" upper-tier of the developing world. These important and increasingly advanced countries have contacts with a wide variety of multinational enterprises in contrast to upper-tier countries such as Saudi Arabia which thus far have interacted mostly with oil multinationals. At the same time, these more or less "assertive" upper-tier countries are extremely sensitive about possible threats by multinationals to their national autonomy, and they seek to control and to compel an improvement in the terms of their relations with foreign enterprises through the employment of stringent legal/administrative regimes on foreign capital. (This "assertive" strategy on foreign firms contrasts with that followed by newly industri-

8

Introduction

alizing developing countries such as Hong Kong, Malaysia, the Philippines, Singapore, Taiwan, South Korea, and Thailand, which seek foreign-enterprise-assisted growth through relatively accommodating regimes.) 17 India's experience may be illustrative of what can be achieved by only a narrow band of other developing countries as they bargain with multinationals in high-technology enterprises. However, while few in number, the "assertive" upper-tier developing countries are especially important hosts of foreign direct investments from the advanced capitalist societies. According to an estimate of the Organization for Economic Cooperation and Development, the total book value of foreign direct investments from the advanced countries in 101 developing countries reached $88 billion in 1978; of this total about 40 percent was accounted for by investments in the "assertive" upper-tier countries. In contrast, only about 14 percent of all such investments were in the "accommodating" members of the upper tier, and only around 6 percent of all investments from the capitalist countries were in the oil-exporting countries (excluding Indonesia, Nigeria, and Venezuela). 18 A discussion of India's computer experience may yield important insights about possible power shifts between developing countries and a very large percentage of foreign investors from the advanced capitalist societies. In addition, many studies have already been conducted on power shifts in favor of a wide range of developing countries as they negotiated with foreign firms in several natural resource, and a few manufacturing, industries. 19 Together with the Indian case the studies span almost the entire range of possible bargaining encounters between developing countries and multinational enterprises. Hence, together with these examples of successful bargaining encounters the Indian case reveals the growing power of many developing countries over almost all types of multinational enterprises. 20 AN OVERVIEW OF THE STUDY

This study seeks to describe and to explain India's increasing capacity over a period of fifteen years to transform its ties with the international computer industry in such a way as to increase its share of the benefits resulting from interactions between the

Introduction

9

country and the industry. Chapter 2 begins this effort by reviewing the factual record of India's experience with computers and the international computer industry. T h e chapter analyzes the objectives of the Indian government with regard to the country's computer industry and to foreign computer firms operating in India. These objectives were publicly specified in the mid-1960s, and their analysis permits the establishment of a standard or measuring rod against which progress can be observed and assessed in India's performance in the computer field. An examination of key governmental policy statements indicates that the overall goal set by the government for itself and the country was to become autonomous and technically sophisticated in the shortest time possible. This general goal was operationalized by the government through the enunciation of three specific objectives: Indians should participate in the ownership and control of any units established in the country by foreign computer firms; wholly Indian firms should emerge quickly and satisfy the bulk of the nation's computer requirements; and Indians should have access to the most advanced computers and computer fabrication technologies available internationally. This specification of performance standards is then followed by a report on data reflecting upon changes in India's success in meeting its computer goals. On the basis of government documents and relying especially on interviews conducted by the author with governmental officials and corporate executives, a measurement is taken of the government's changing ability to offer incentives and to bear costs sufficient to reformulate the country's ties with the international computer industry in terms of corporate control and the activities of the foreign computer firms in India. Chapter 2 also presents data (collected through interviews and analysis of governmental and private reports) on the structure of the Indian computer market during the 1960-1980 period and on the levels of technological sophistication of the foreign-origin systems installed in the country during these twenty-one years. Evaluation of these data allows for an assessment of changes in success of indigenous systems suppliers and of changes in the ability of the country to gain access to increasingly sophisticated foreign-origin systems. Finally, a comparison is made of the types of manufacturing activ-

10

Introduction

ities undertaken in the country over time in the computer field as another indicator of changes in the country's ability to gain access to advanced computer technologies. On the basis of these data the principal empirical finding of Chapter 2 is that after a period of regression in the late 1960s India did achieve progress in the mid- to late 1970s along each of the major dimensions of the computer policy established by the Indian government in the mid-1960s. For example, while in the late 1960s the Indian government decided that it could not insist that IBM share equity with Indians for fear that the company might exit from the country, by the late 1970s the government was in a position to decide that it could sustain the loss of IBM in pursuit of a new effort to force equity sharing by foreign firms in India. (As is explained in the text, however, it is doubtful that the government really needed to force the exit of IBM.) Moreover, while in the 1960s a second foreign computer firm, International Computers Limited (ICL), was able to organize its Indian operations to exclude effective Indian participation in the direction of the firm's Indian activities in spite of permitting some Indian shareholding, in the late 1970s ICL was compelled to change its corporate structure to allow meaningful participation by Indians in the control of ICL's operations in the country. Finally, as a result of government pressures and policies Burroughs in the mid-1970s decided not to try to establish a wholly owned subsidiary in India and chose instead to form a joint venture with an Indian enterprise, Tata Consultancy Services, in which each had an equal equity holding. In addition to acting more effectively in the areas of corporate organization, the Indian government in the mid-1970s set into motion policies that fostered indigenous supplies of computers and which led to greater access to more advanced international technologies. However, in contrast to the preeminent role of the government in the corporate organization issue area, we find in Chapter 2 that at the end of the 1970s success by the country in terms of market shares and advanced foreign-system imports was less the result of government policies and more the outcome of efforts undertaken by elements of the Indian computer industry outside the central government. Equally striking about the late 1970s is the reluctance of the central government to allow these new entrants into the Indian

Introduction

11

computer industry even though they were indigenous in character. The eventual lack of success on the part of the government in keeping new indigenous enterprises from entering the industry and its inability to limit imports of modern systems to the level it preferred suggest that while the Indian government was more powerful in directing the course of computing in the country during the 1970s than it had been in the 1960s, nevertheless forces emerged from within the Indian computer community to limit the government's ability to dictate how the industry would evolve. Yet the key finding remains that Indian actors—the central government and enterprises not under its direct control—were able to undertake actions which led to an improvement in India's computer industry according to the objectives established in the mid-1960s. The major challenge of the study, of course, is to explain why India was able to formulate a more favorable relationship for itself with international computing, and it is also necessary to explain the limits of the Indian government's ability to lead this reformulation of relations between the country and the international industry. Clearly a wide variety of factors interacted and contributed to the sequence of events described in Chapter 2. For example, India possessed in the mid-1970s highly skilled but inexpensive software personnel, and this high-value labor was an important factor in increasing the willingness of Burroughs to comply with Indian governmental requirements on equity sharing. Moreover, it was the increase in international suppliers of systems and technology, which in turn was a reflection of a lowering of barriers to some extent in at least certain segments of the international industry, which allowed India to choose from a wider array of international enterprises. Finally, there was the factor of the potential fast growth of the Indian computer marketplace (as the country continues to industrialize) which served to increase the willingness at least of Burroughs and ICL to comply with India's demands. These and other factors played a role in leading India to be more effective in the computer field during the 1970s. For the sake of clarity two basic sets of forces can be identified. The first set of factors—the topic of Chapter 3—involved changes in the international computer industry. Here we explain how the emergence of increasingly less expensive computer components

12

Introduction

and peripherals (resulting from technological innovations originating in the advanced countries), whose availability to India was accelerated by the increasing déconcentration of the international industry, gave India the opportunity to develop a strategy in the mid- to late 1970s of systems engineering of minicomputers and microcomputers (whose architectures also were the product of technological advances in the advanced countries). While not a costless approach, the new strategy nevertheless allowed India potentially to have indigenous suppliers of relatively efficient systems and to become less dependent on the decision of any single foreign enterprise for the evolution of the Indian computer industry. Note, however, the emphasis on potential opportunities. International technological innovations, the presence of which was facilitated by change in the international structure of the data processing industry, constituted one necessary condition for improvement in India's position in international computing. Chapters 4 and 5 seek to show that operating in India was a separate set of factors which constituted a second necessary condition for India's changes in fortunes in computing. Chapter 4 shows that improvement in the country's computer situation in the mid-1970s was a result of a new Indian approach to data processing and that this new approach—developed and executed by the government—made use of the international opportunities described in Chapter 3. It also argues that a shift in the policies of the Indian government at the end of the 1970s can be observed and indicates that the government experienced a diminution of its ability to lead the country's computer community. Chapter 5 then takes this argument concerning Indian domestic institutions a step further. First, the chapter shows that international opportunities described in Chapter 3 were available to a small degree in the late 1960s, that is, the period during which India was least successful in its relations with the international industry and in its effort to foster an indigenous industry. This suggests that the presence of international opportunities by itself cannot explain India's improvement during the 1970s. Chapter 5 explores more fully the argument that the second necessary condition for the country's improvement in computing was domestic in origin. T h e chapter shows how the

Introduction

13

new and successful Indian approach to computers (discussed in Chapter 4) was made possible by the emergence within the Indian government of effective policy institutions in the field of data processing, for these new institutions (explained in Chapter 5) gave India the capability to exploit the international developments reviewed in Chapter 3. Chapter 5 accounts for the emergence of these new institutions by reference not to conflicts with international computer firms but rather to more fundamental political struggles within the Indian government for control over the entire Indian electronics industry. The chapter also explains how political dynamics between the Indian computer community and the government, and within the latter itself, served to limit the ability of the government to pursue its preferred strategy for computers. The Indian computer industry did evolve in the mid-1970s in a way more closely in line with the objectives of the government (and for it to do so the government had to forge new ties with the international industry), but Chapter 5 shows how Indian domestic political-economic developments placed a limitation on the government's autonomy in setting the course for Indian computers. Serving as the conclusion of the study, Chapter 6 contains two major arguments. First, India's experience with computers strongly suggests the overall analytical superiority of the bargaining school over the Marxist-dependencia school. However, the second major argument is that the bargaining school may not fully appreciate the power of its central insight concerning changes over time in relations between developing countries and multinational enterprises. Not only is it true that developing host countries can attain increasing levels of control over multinationals in natural resource and low-technology manufacturing industries, but this may also become increasing typical of bargaining relations involving "assertive" upper-tier developing countries and high-technology manufacturing enterprises. The chapter suggests that the bargaining school underestimates the potential of "assertive" upper-tier countries to adapt to opportunity-producing international technological innovations. What emerges from the study is the point that there are important similarities between bargaining instances involving low-technology enterprises and "assertive" developing countries on the one hand, and, on the other hand, high-

14

Introduction

technology enterprises and these countries. Indeed, Chapter 6 shows that even the limits on the Indian government's autonomy at the end of the 1970s (as described and explained in Chapters 4 and 5) are similar in cause to the limits observed in a key case study undertaken from the viewpoint of the bargaining school of the experience of a developing country with natural resource foreign enterprises. Moreover, the chapter suggests that India's experience may not be unique, for other "assertive" upper-tier developing countries also are restructuring their ties (with varying degrees of success) with the international computer industry and at least one other hightechnology industry, pharmaceuticals. Finally, the chapter presents a few concluding thoughts on what India's experience with the international computer industry may suggest about the power capabilities of developing countries in the contemporary international economy. CONCLUSION

This chapter has sought to outline the main empirical findings and theoretical arguments of the study. It must be stressed that the study does not argue that all technological innovations have the effect of increasing the potential bargaining capabilities of "assertive" developing countries. Instead, the more modest goal of the study is to show that technological innovations may have different implications for the level of the barriers to entry of different segments of a manufacturing industry. T h e argument is that while technological innovations may make some segments of an industry more difficult for a developing country to master (and thereby to be in a better potential position when negotiating with multinationals in the industry), the same innovations may render other segments of the industry more accessible to entry by the developing country (which could make the country less dependent upon, and therefore more powerful in negotiations with, multinationals in the industry). It must also be emphasized that the study does not seek to argue that India was able to become wholly independent of the international computer industry, nor to argue that any developing country can expect to become wholly autonomous in

Introduction

15

high-technology industries in the foreseeable future. Rather, our claim is that over time India developed the capacity to improve its position within international computing and that certain specific developments within the latter actually facilitated the progress achieved by India. The advances made by India, however, were the result of a decision by it to remain associated with the international industry, albeit on new terms. Also, India in the late 1970s was certainly more autonomous in computing than it had been in the late 1960s, but it was equally clear that it could not forego its ties to international computing. In sum, in the field of data processing India in the 1970s reached a position somewhere between dependency and autonomy.

Chapter II

India's Changing Fortunes in Computing, 1960—1980

This chapter describes India's experience in data processing and with international computer enterprises. Two sections review the background to and major objectives of the Indian government's policies as of the mid-1960s in the areas of foreign capital in general and in electronics and data processing in particular. This discussion provides a yardstick to measure India's changing ability in the 1960s and 1970s to meet the objectives set for it by the government. In the third section, data are reported which reflect quite clearly on the degree to which the objectives were met as a result both of Indian governmental and nongovernmental actions. As noted in Chapter 1, the key empirical finding of the present chapter is that India in the late 1960s failed to meet its computer policy objectives but reversed this adverse trend and did achieve progress in the mid- to late 1970s. However, the evidence also suggests that over time different segments of the Indian indigenous computer community were more responsible than others for this progress. Specifically, at the end of the 1970s Indian actors outside the government grasped leadership from the latter in advancing toward the government's computer policy objectives. T o highlight all of these changes the fourth and final section of the chapter compares and evaluates the progress made by India in the fourteen-year period after the government had set explicit goals in the computer field. INDIA AND FOREIGN CAPITAL

India possesses one of the world's most restrictive, cumbersome, and "assertive" regimes regulating foreign direct in-

India's Changing Fortunes, 1960—1980

17

vestments. Recently, a comprehensive survey was taken by the U.S. government of the overseas operations of U.S. enterprises as of 1977.1 The enterprises were asked to report on the performance requirements and incentives they encountered abroad. The resulting rates at which U.S. firms encountered at least one requirement or incentive in the major developing host countries are reported in Table 1. For U.S. investments in the developing world throughout the postwar period, India imposed one or more requirements on U.S. firms more frequently than any other "assertive" country. Indeed, the rate of 60 percent at which U.S. firms encountered performance requirements in India was higher than any other country in the world.2 For U.S. enterprises expanding or establishing operations in more recent years (1970—1977), India no longer was the country with the greatest requirements; instead, its performance requirement rate declined to 46 percent and was surpassed by Peru, Venezuela, Mexico, and probably Nigeria. Nevertheless, in terms of the ratio of requirements to incentives India became even more "assertive" during 1970-1977, and this "assertiveness" by India was surpassed during this later period only by Peru, Venezuela, and perhaps Nigeria . India maintains this regime even though the evidence suggests strongly that it inhibits the receipt of new foreign investments. India is an important host to foreign capital: in 1978 its total stock (totaling $2.5 billion) placed it seventh among 101 developing countries. But during 1969—1976 at least sixteen developing countries had a larger inflow of foreign direct investments than India (whose total inflow was $345 million). All of the "assertive" countries except Colombia and all of the "accommodating" countries except Thailand received more foreign capital than India during 1969—1976.3 Moreover, this situation concerning total flows is not driven by any single source of foreign capital: whether one looks at investments from the United States (for 1966-1976), Great Britain (during 1962-1974), or West Germany (for 1965-1976), India's receipt of new foreign capital is less than all of the other "assertive" upper-tier developing countries.4 The country's attraction of new foreign capital has been relatively low even in the area in which it occupies a leading position within the developing world, that is, manufacturing, in

I-H

R O

0 0

CM

O

CM

O

O I~H

O

0 0

O

E Ò

O

Ö

L >

E C

I M CO

Ö

AN

LF>

O

D

8

« 5

C

H

« OÁ

S - A FC C . O CFL

8 C RT

T : L L I Q CL

O T-H 0 0 I N

S S

1-H

CM

O

I—.

LO

O

1 >

O I

D

I >

CM

CT) D

D

O I N

CD D

M

CM

TO

O

D

D

D

D

E

S-

T-, OJ

B O

3

S

O

• S

J3

h

CL,

,

C - ¡ I

(

O

O

-

^

C

M

C

T

I

O

O

O

I

O

^

H

T

O

C

O

«

J

C

O

«

3

U

U

V

D

E

U

S

;

O

U

5

Ï

O

—

e I« Ê i

Ti í C 60- . s « í fli S t« ® J3 oo • S ^ s « 01 . O —i S « . Sr u D D o J ' 5 i. ¡U 3 3 . S ^ Q¿ ° "03 w 0 "" "O W J3 • U S —• o i D W 1 — ' 3 Q-c » C « C -O O

olz

-ü-S Já S c l « m M 1 • CO

3

J J, -fi w ce

'3 Rf e

23

(A

M U w

S

03 S

3 3 a O Si ¡X 3 P3 U

i

c V 1. 2. w0 f

"O

c abp

cu J2 « CL, J,

-

V'

J¿

5

V C O

Q

X

DC

'C

—t u

«2

s

£

«

S •3

CQ

QJ > O

en

u

V OuJ JS js O

O

S

a i

^ O S ^ tM « A i •» «« 2 ° K h ¿ í CT) 3bD>

fe g

Ii a8 C!

u

u b « ^ 1 T3 —i S 4-j ra •a 2 (S M

India's Changing Fortunes, 1960-1980

35

and II for the 1973-1977 period, especially with regard to ECIL installations. T h e figure in Estimate II for ECIL installations is taken from a nongovernment study published in 1980. This data is presented on a fiscal year basis (i.e., April 1-March 31). Therefore, it was assumed that an equal number of systems was installed by ECIL during each quarter of its fiscal year, and it was assumed that one-fourth of the systems reportedly installed in 1972-1973 and three-fourths of the systems reportedly installed during 1977-1978 were delivered within calendar years 1973 and 1977, respectively. Figures in Estimate II for non-ECIL systems are from the 1978 government study on which Estimate I is based, but it has been adjusted with the addition of systems in cases such as IBM and ComputerAutomation, in which systems were reported by the study to have been installed but without specifying the year of installation. This procedure for Estimate II may overstate slightly the number of foreign systems in India during 1973-1977. Regardless of the figures which are used for comparison, ECIL clearly became a markedly more important factor in the Indian computer market during 1973-1977. ECIL was the source of no more than 8.5 percent of all computers during 1967-1972; during 1973-1977 this market share increased to between 40 percent and 50 percent of all new installations. Also, during 1973—1977 there was an increase from four major sources of systems in India to nine major sources. However, during 1973-1977 IBM's market share collapsed, and, as will be explained in Chapters 4 and 5, this was the direct result of Indian governmental efforts. Technology

of

Systems

India's improved performance in this area can be observed in Table 5, which reports the temporal-technological lags for the 1960-1966,1967-1972, and 1973-1977 periods. By cutting the refurbishment programs of ICL and especially of IBM and by returning to imports as the source of foreign-origin systems, India reduced the average difference between the time a computer model was introduced in the West and the time a unit of this model was installed in the country to 3.7 years, a marked improvement over the lag of 8.5 years during 1967-1972.

36

India's Changing Fortunes,

1960-1980

TABLE 5

Lag of Foreign Computers in India, 1960-1977 1960-1966

1967-1972

1973-1977

33

126

95

Total lag (years)

145

1069

351

Average lag (years)

4.4

8.5

3.7

82.5

90.0

N u m b e r o f systems

% o f f o r e i g n systems in survey

8 3 (Estimate I) o r 6 7 (Estimate II)

Note: As explained in.the sources for Table 4, Estimate II for the 1973—1977 period includes several foreign systems which were installed by 1977, but for which exact installation dates are unavailable. The exclusion of these systems thus lowers the percentage coverage of foreign systems in the survey for Estimate II, 1973-1977, compared with Estimate I. Sources: Data for this measure are the same used to construct Table 3.

Another way to observe technological improvements in India's computer situation during 1973-1977 is by focusing on its computer fabrication programs undertaken or in final planning stages during this period. The measure employed here is the cost per bit of main memory used by the central processor (the unit which performs computations and which controls the computer system as a whole) of only those systems fabricated in the country (or proposed for production). The data are presented in Table 6, and compared using this measure are the major systems fabricated in India during 1967-1972 (the IBM-1401), the systems that IBM hoped would succeed the 1401 in India beginning in the early 1970s (the 360/30 and 360/40), and two systems fabricated by ECIL during the mid- and late 1970s (the TDC-312 and 316). Both the TDC-312 and 316 have a better cost performance for main memory than the 1401 and the 360/30, and the 316 has a better cost performance than the 360/40. This suggests that the systems that were fabricated in India during 1973—1977 were technologically more advanced than those fabricated during 1967-1972 by the IBM unit in India and that they were also more advanced than the systems IBM proposed to have follow the 1401. It should be noted that in 1971 IBM proposed to follow its 360 refurbishment program with the assembly of new and pre-

India's Changing Fortunes, 1960-1980

37

TABLE 6

Per Bit Costs of ECIL and Selected IBM Main Memories Company System

Year introduced Cost per bit ($ current)

IBM 360130

360/40

1960

1965

1965

1974

1975

0.93

0.32

0.21

0.25

0.14

1401

ECIL TDC—312

TDC—316

Note: Indian Costs are translated from rupees at an exchange rate of 8 rupees per dollar. Sources: The data for IBM systems are Montgomery Phister, Data Processing Technology and Economics (Santa Monica, Ca.: Santa Monica Publishing Co., 1976), pp. 339, 342; data on the T D C - 3 1 2 and 316 are from O m Vikas and L. Ravichandran, "Computerization in India: A Statistical Review," Electronics: Information Planning 6 (December 1978):327; and Om Vikas, "Indigenous Development of Computer Systems, Peripherals, and Computer Communication Facilities," Electronics: Information and Planning 5 (August 1978):793, 807, 811.

viously utilized IBM-370's (probably the models 115, 125, or 135).41 Any of these systems would have been superior to the ECIL systems, thus raising the question of whether India suffered by its refusal to accept IBM's offer. However, ICL agreed in 1977 to assemble new ICL-2904's in India (the 2904 had been introduced into Britain in 1974 and 1975). 42 In terms of size, speed, and cost the 2904 compares well with the 370 models IBM considered fabricating in India. 4 3 In any event, in 1974 IBM, aware that the government was firmly opposed to the 370 proposal, withdrew it in favor of a proposal to manufacture line printers at the company's Indian facility. 44 THE 1978-1980 PERIOD

Corporate Organization and Control During this period foreign firms in compliance with India's ownership requirements consolidated their computer operations in the country. First, ICL merged its two units within what previously had been the company's manufacturing arm in India, International Computers Indian Manufacture Limited (ICIM), and 60 percent of the ownership of this new enterprise was controlled by Indian individuals and institutions. T h e size

38

India's Changing Fortunes, 1960—1980

of the operation remained at about 400 employees, and after substantial delays ICIM began in 1980 to assemble and market ICL-2904's in India.45 However, ICIM failed in meeting a commitment to the government to produce peripherals. Second, Tata-Burroughs was created in December 1977. By the end of 1980 it had over 200 employees involved in overseas software projects, the marketing and servicing (for one year) of systems in India, and the manufacturing (for export) of dot-matrix printers.46 Third, between January and June 1978-IBM withdrew from India. The exiting process involved the settlement of tax and other financial matters with the government, the sale of systems to customers previously renting the units, and the placement of many of the 800 former IBM employees into new jobs in India (about 300 had left IBM/India in 1976-1977 and had been given support by the company). IBM/India also trained personnel from the government's new Computer Maintenance Corporation to service IBM systems remaining in the country. Finally, IBM established in New Delhi a "liaison office," which served as the only ongoing presence of the firm in India after June 1978.47 The major development in India's computer industry during this period was the emergence of several indigenous systemsengineering firms not under the control of the central government. The first of three wholly private Indian computer firms was DCM Dataproducts (DCM), a division of the very large Delhi Cloth and General Mills Company Limited. DCM Dataproducts began with hand calculators in 1974 and sought from 1975 to move up to minicomputers. Blocked by the government in minicomputers (described in Chapter 5), DCM developed and began in 1978 to deliver two microcomputers, the Galaxy 11 and Spectrum 7. By 1980 DCM had offices in thirteen Indian cities and a total of 800 employees. 48 Another new entrant was Hindustan Computers Limited (HCL), a joint venture formed in August 1976 by a private firm (Microcomp Limited), and an Uttar Pradesh state firm (U.P. Electronics Corporation Limited). Microcomp was formed in 1975 by ex-DCM employees frustrated by the latter's inability to obtain a computer fabrication license from the government. HCL's first product in 1976 was a desk-top microcomputer, the Micro 2200, and by 1980 it was delivering two quite large micros, the HCL

India's Changing Fortunes, 1960—1980

39

1600/1800 and the HCL-8C. HCL had 600 employees in six Indian cities by 1980, and in 1979 the firm announced the formation of a systems-engineering venture in Singapore with the Economic Development Board of the government of Sing49

apore. Two other wholly private firms which entered the microsystems-engineering industry in India at the close of the 1970s were the Operations Research Group (ORG), and International Data Management Limited (IDM). The former is a division of one of the largest family business houses in India, Sarabhai Enterprises, and was formed in 1960 as a management research and consulting firm. Working with computers and large data bases for its studies, ORG developed substantial expertise in software, and in the mid-1970s it exported software to the U.S.S.R. and served as the Indian sales and service group for the Univac Division of the Sperry Corporation. Research on possible ORG microcomputer architectures began in 1975, and in 1978 a separate division was established (it grew to 400 employees in six cities by 1980) to market its in-house microsystem, the O R G - 2 1 0 0 and to manage the firm's relations with Univac and with Soviet software customers. 50 Finally, IDM was created by former IBM employees. Most of IDM's 170 employees in 1980 were former IBMers, and indeed IDM began its operations as IBM terminated its activities in June 1978 (IDM had been incorporated the previous January). At first IDM concentrated its efforts on the former IBM data processing centers located in half a dozen cities around India. However, in late 1978 IDM became the sole sales and servicing agent for the Nelco 3000 microcomputer, designed and assembled by the National Radio and Electronics Company Limited, a subsidiary of Tata Enterprises (and one that is organizationally separate from Tata Consultancy Services Limited, Burroughs's partner). Moreover, at the end of the decade IDM became the representative (for sales and one year of service) of three foreign computer enterprises: Prime (for which IDM located several customers for systems to be delivered in 1981), National Advanced Systems, and Hitachi.51 In sum, by the end of the 1970s India had two foreign computer enterprises manufacturing in the country in accord with the ownership requirements of the Indian government, and the

40

India's Changing Fortunes, 1960—1980

country witnessed a rapid increase in the number of wholly indigenous systems-engineering enterprises. While in the early to mid-1970s only the government's enterprise, ECIL, designed and assembled (with imported components) computer systems, by 1980 three other firms had designed and were assembling their own systems, and a fourth marketed a microsystem produced by another wholly Indian enterprise. To give some sense of the overall evolution of the Indian computer sector, it may be noted that at the beginning of the 1970s the total employment in the country's computer industry—that is, employment at IBM and ICL—was probably around 1,500 persons (ECIL's Computer Division probably had not more than a few dozen employees). In contrast, by the end of the decade employment in the industry—that is, the two foreign firms, ECIL, and the four other wholly Indian companies—may have surpassed 3,500 individuals, and more than 80 percent of these were in wholly Indian enterprises. 52 What is equally striking, however, is that within the wholly Indian sector one observes the most rapid growth not in ECIL but in the private firms and in one involving a private and a state-owned enterprise. For example, while in 1980 ECIL Computer Division employed about 1,000 persons, the combined employment of non-ECIL wholly indigenous computer firms (firms which did not exist as systems suppliers until as late as 1975) may have exceeded over 1,900 individuals, or 65 percent of all wholly Indian computer sector employment and about 55 percent of all employment in the entire sector within India. India had a growing computer sector at the end of the 1970s, but a striking feature of its development was the sudden emergence at the very end of the decade of wholly Indian firms which were unconnected to the central government and the latter's own ECIL. Market Structure India's continuing progress in this area can be observed in Table 7. Data are unavailable for the actual installation of most foreign-origin systems during 1978-1980. For the most part Estimate III presents data on the number of systems approved for import by the government. Also, following the logic used in the construction of Estimate II in Table 2, it was assumed that

© H

© Tf

t^ N

t»

cn

m

o

-

S Z,

«

o ai

a « o

"Q -s ^

f a i ?

V

TS

«>

g - G

^ s g

11

XI o>

E U rH

til -Ü v

i

I

d

«T *

M 5

i

Ci 4 »> •s — C. • ©> a < CL

h i

S . «y i^ a o ^

*7

o l

fi O ì bo—

< Cb CK3 tu se S >-! M 3 o s a. 0 R" 1 X e 3 sr t u n v > 3 n 3 t u S c CL > §• 3 ^ g- £ "t m -n 3 tu tu » ¡u 3 > 3 a 3 3 » Q. 3. i Cd • i O f» tu 5T ao" n 3 3 5p" a3 3

tu

^

-

S ¡X) 2 S. H > - § w O' g r 3 Si. w m r no S ft o 5 O- w ? s O c/3 s. rt- *^ s tu tn VD

« G .o u (•w elis w 3 m w

V C

«

C/}

~0 s

aii u w c a a; «S •

S

o

e o Vi

•s

O (M M «-J < H

I

i> u « w C/3 V J3 • W TJ C «

Q * J E pq

a. w U

"S w t/3

o S o Q

-g c Oh

a m .C t- bo S « ' go

.3,

U

S

ii V n V a.

O C -3 rt •» i! LO u rt E rS o U Q-U h -o «j SL 60 g S O is S u y u-O * IH U w "c3 g.s« T3 C

o x> rt hJ IL) T3 11 3« • SJS•> c S o ^ OH C/3 Z en O

ä

s -o

3 rt 3

Q [in U

«î U u PS 3 11 TJ u M o fcT6V u Q T3 3 in 3 ,o JS U u IH U be 3 O U

Ë

"C 5H oo ea o

Z

a; S-S " C8 g « U e5 « •S Oy (333 Q a 3 5 c a 3 S bo £ w c 3 X ^ c« r " S rt m c PQ bcgU n >i 3 bc « ^.. sb O ^ £ CO S 3Oh < 3

X

Policies, Politics, and Computers

145

peared to be emerging in the first half of 1977. If true, then Fernandes would need to be concerned about criticisms from Shekhar and other leaders of the Left. Given this dilemma, perhaps Fernandes pushed for harsh treatment of highly visible multinationals like IBM and Coca-Cola in order to strengthen his left flank. Fernandes could then act more confidently, but with great discretion, to attract multinationals in select industries. This of course would not be the first time that political leaders would "talk left and act right." 101 T h e third and final cluster of actions relating to India's computer experience involved the entry by several noncentral government firms into data processing over the opposition of the Electronics Commission and Department. At least four such firms began operations during 1978—1980, and a total of fortythree received licenses during 1979—1980. T o explain these developments it is possible to refer to the Janata government's stated economic strategy of focusing state activity in agriculture (thus creating more opportunities for the private sector in industry) and its interest in fostering small companies. 102 This latter point may have helped HCL and perhaps IDM, but certainly not DCM or ORG, which were components of large business houses (Delhi Cloth Mills and Sarabhai Enterprises, respectively), and IDM wanted to market a system produced by a subsidiary of Tata Enterprises. Public statements of national economic strategy by the Janata government do not shed much light on the computer situation during 1978—1979. Execution of such a "strategy" would require, first, a consensus within the Janata coalition about strategy, and, second, an agreement on instruments for its execution. Both of these conditions were not met during the Janata period. By 1978 the Janata government was engulfed in an "internal war" involving, most especially, Prime Minister Desai and, until his forced resignation in July, Home Minister Charan Singh. (After July Charan Singh was still a formidable factor in Indian politics, and in recognition of his strategic value, he was able to reenter the government as finance minister in February 1979. In July he became prime minister but lost his governing majority in the Parliament in August. From then until the victory by Indira Gandhi in January 1980, Charan Singh headed a caretaker government.) As strife within the Janata govern-

146

Policies, Politics, and Computers

ment escalated during 1978, the machinery of government, according to observers in and outside of India, began to appear almost paralyzed, unable to initiate policies or even to control rising levels of social disorder within the country. Equally significant during this period was one particular line of attack used by Charan Singh and—from her seeming political isolation in 1978—Indira Gandhi against Prime Minister Desai. In essence, the charge was that Desai's economic policies amounted to government capitulation to "multinationals" and "monopolistic" domestic enterprises. 103 One might have expected that the weakness of the government at its apex would have allowed greater leeway to bodies like the Electronics Commission and Department to act on their own: However, the policy preference of the latter two units, to have only ECIL as the leading indigenous computer enterprise, required interministerial cooperation (to control the issuance of import licenses and to monitor actual imports of items listed in industrial licenses) that was virtually impossible during the turbulence of 1978-1979. Hence HCL and DCM, and perhaps ORG, were able to evade efforts by the commission and department to keep them out of microcomputers. (It is also likely that the criticisms in the press lessened the zeal of the two policy units to try to stop the firms by late 1978.) Also, while Prime Minister Desai probably did not direct the day-to-day operations of the commission and department, his sensitivity to attacks made in the Parliament about computers in particular and to charges made by Charan Singh and Indira Gandhi in general about Desai's alleged favoratism toward foreign and large domestic enterprises probably led him to conclude in late 1978 that he needed to shift Professor Menon out of electronics. Perhaps it was a fear of such criticisms, together with concerns about charges relating to multinationals, which explains why Fernandes's Ministry of Industry pressured the commission and department to allow the entry of several firms into the computer industry in 1978. In any event, Professor Menon's replacement, Professor Nag, moved to limit complaints about Tata-Burroughs and ICL by granting formal licenses to DCM, HCL, ORG, and IDM. Granting licenses to these four enterprises was insufficient, however, for the DCM and ORG cases could be related to favor-

Policies, Politics,

and Computers

147

atism toward big business. Once the first set was issued, new pressures arose to grant additional licenses. During 1978—1979 it was therefore the profound internal weakness of the Janata ruling coalition which probably aided the noncentral government computer firms in their struggle with the Electronics Commission and Department. Finally, both Charan Singh, during his brief period of leadership in late 1979, and Indira Gandhi, after she returned to power in January 1980, probably believed that not granting the licenses to additional enterprises could expose them to the same criticisms that had been made against Desai in 1978. CONCLUSION

From the above discussion at least four conclusions emerge. First, the particular evolution of computers in India until the late 1970s was very much a reflection of changes in the balance of power between two major bureaucratic factions or networks within the Indian government. In the 1960s the close balance between the Ministry of Defense and the Atomic Energy Commission led to a stalemate within the Electronics Committee, and it was this paralysis which made effective action by the government difficult both in terms of fostering an indigenous industry and in terms of forging satisfactory relations with the international computer industry. Later the balance shifted in favor of the atomic energy network, and with this resolution of the struggle the government finally was able to pursue in the early to mid-1970s what at least was a clear path in electronics and computers. T h e path charted by the commission and department allowed for the reformation of the country's ties with the international computer industry, and it led to the emergence of an indigenous enterprise able to use international technological innovations to supply systems within India. However, the second conclusion to emerge is that these actions of the commission and department led to an expansion of the arena of potential political struggle concerning computer strategy and policy outside of the government and into the broader Indian computer community. First, by permitting imports of minisystems so that the country would familiarize itself with this new technology and thereby be more receptive to

148

Policies, Politics, and Computers

ECIL small systems, the commission and department created high expectations among Indian users. When ECIL, perhaps because of all the protection the commission and department sought to provide it, could not meet these expectations, the user community had an incentive to try to defeat the policies of the commission and department to channel users toward ECIL. Second, by announcing that India should turn to indigenous small systems, by succeeding in fostering ECIL as a supplier (albeit with a low-quality product), and by redirecting foreign firms into larger systems or, in the case of IBM, causing a vacuum to be created with its withdrawal, the commission signaled to potential indigenous suppliers that a new set of commercial opportunities might be open to them (this was certainly the message of the Minicomputer Panel in 1972-1973). When the commission and department sought to protect ECIL by preventing the entry of these new firms into the industry, the latter had cause to seek the weakening of the authority of the commission and department in the computer field. Third, as the conflicts involving Indian computers broadened to include these new contestants, the commission and department found that their powers were inadequate to pursue their preferred vision of the future of Indian computers. First, Indian computer users—in and out of the government (with the exception of the police and the universities)—were able to devise effective counterstrategies to the effort of the commission and department to channel them toward ECIL. Second, and more significantly, enterprises seeking entry into the smallsystems industry devised and executed a series of actions which resulted not only in their commencement of operations but in the near destruction of the commission and department. These actions by the firms seeking entry probably were supported by governmental factions opposed to the commission and department, and the combination of the two forces led to the defeat of the strategy devised by the two electronics policy units in the early to mid-1970s. T h e commission and department had not been wholly unsuccessful; indeed, the lasting change they brought about probably is in the area of linkages between the country and the international computer industry. Yet one clear lesson of computers in India is that it is often much easier to reform economic ties with external agents than it is to sustain an economic policy in the face of domestic resistance.

Policies, Politics, and Computers

149

To a great extent the evolution of computers in India can be explained by reference to international technological and industrial changes and to the "micro" political dynamics summarized in the three points made above. However, the fourth and final conclusion is that "macro" political forces within India also affected the way in which the country's computer industry evolved. National political dynamics probably did not affect the day-to-day operations of policy institutions and private actors involved in Indian computing, but in a variety of ways these units sought to exploit these dynamics to their advantage (usually at the expense of other actors in the industry). Thus, at both the "micro" and "macro" level of analysis, the development of computers in India was a profoundly political phenomenon.

Chapter VI

Conclusion

In this final chapter we begin with some theoretical insights generated by the study for our understanding of relations between "assertive" upper-tier developing countries and multinational high-technology enterprises. Next, we examine these insights in the light of the experiences of other developing countries with multinational firms in the computer industry and in one other high-technology industry, pharmaceuticals. Finally, we present the implications of the Indian case study for our understanding of the prospects for future international order.

THEORETICAL IMPLICATIONS

T h e case of India and the international computer industry allows for several insights into the general problem of power relations between developing countries and multinational enterprises. First, India's relationship with the international computer industry evolved in a manner that fits closely within the basic predictions made at almost the outermost edge of the analytical power of the bargaining school. Hence, these "hard case" findings lend strong support to the bargaining school's basic contention that, over time, developing countries can increase their power over multinational enterprises. From the perspective of the Marxist-dependencia school, on the other hand, India almost certainly should have failed in its negotiations with the international computer industry. Yet this relatively "easy case" did not evolve as expected, and therefore the case offers strong grounds to question the validity of Marxistdependencia arguments concerning relations between multi-

Conclusion

151

nationals and at least the "assertive" upper-tier developing countries. While the Indian case suggests the overall theoretical superiority of the bargaining school over the Marxist-dependencia school, it also suggests a possible reformulation of elements of the first school's analysis. According to the bargaining school, international technological change tends to constrain the range of choice of developing countries in their relations with international firms even after taking into account increasing levels of international competition among these firms. T h e case of computers in India suggests, in contrast, that international technological innovations, whose availability was facilitated by changes in the international structure of the industry, actually expanded the range of possible computer choices for India and thereby directly improved the potential capabilities of the Indian government as it bargained with IBM and ICL. After the Indian government had established its small-systems strategy based on the international technological developments of minisystem architectures and increasingly less expensive components and peripherals, attracted foreign firms to Santa Cruz to help meet the foreign exchange costs of the new strategy, and fostered at least one domestic supplier by 1973-1974 (ECIL), the government lowered the costs to the country of losing the presence of any particular enterprise, that is, IBM. As it became clear that IBM might be unable to meet the demands of the government, the incentives increased for ICL and Burroughs to comply and thereby to replace IBM to some degree in the country. As Burroughs and ICL became more likely to comply, the costs to India of losing IBM declined even further, and the government was able therefore to persist in its demands even if it meant, and it ultimately did, that IBM would be compelled to withdraw from the country. Hence the first possible revision of the bargaining school is that instead of arguing that technological change consistently constrains the opportunities of developing countries as they interact with high-technology multinationals, technological innovations may be thought of as a force which may inhibit entry by such countries into certain segments of an industry, but may also lower the barriers to entry to other segments of the same industry. Such a lowering of barriers to entry, combined with a

152

Conclusion

déconcentration of the international structure of the industry (which itself reflects a lowering of barriers to entry in the latter), could allow a developing country to become less dependent upon any single foreign firm and thereby be able to move more aggressively toward foreign enterprises in or seeking entry into the country. Of course, the Indian experience also suggests that the government should not use this new-found power too aggressively. In sum, the case of computers in India suggests that a more complete understanding of the impact of technology on interactions between multinationals and at least the "assertive" upper-tier developing countries may need to be more complex than the analysis offered by the bargaining school. At the same time it should be noted that increasing international competition within a high-technology industry may be a prerequisite for technological change to work in favor of hostdeveloping countries. It is an open question as to whether technology-intensive industries other than data processing are displaying the two key characteristics of lower input prices (driven by technological improvements) and increasing international competition. Additional studies should be executed to determine if other high-technology industries are in fact evolving along these two dimensions in a manner similar to that in data processing. If they are, then the bargaining school's basic thesis can be expected to capture events with increasing ease and frequency in what has been to date its most difficult cases. Second, and of equal importance, the Indian experience with computers draws into question the bargaining school's understanding of the domestic capability of developing countries to exploit international technological innovations. According to the school, the adaptive capabilities of developing countries in high-technology areas are severely limited. Yet in India domestic institutions did evolve quite rapidly and in such a manner that the country became capable of exploiting international computer developments to its advantage. At first the domestic change came about within the Indian government. In part as a result of the bureaucratic political struggles and in part as a result of disenchantment with the activities of IBM and ICL in India at the end of the 1960s, new policy units emerged at the beginning of the 1970s to take

Conclusion

153